What We Do

We specialize in providing holistic financial advice that is tailored to each client. Our areas of expertise include but are not limited to the following:

-

Optimization of investment return given level of risk taken

Custom investment plan with appropriately diversified portfolio

Dynamic portfolio positioning and rebalancing

Coordination and consolidation of investment accounts

Fundamental investment analysis

If desired, environmentally and socially responsible investing

-

Tax-efficient strategies for contributions to and withdrawals from investment accounts

Prior year tax return review

Review of current year taxable events and recommendation of tax optimization strategies

Harvesting capital gains and capital losses

Charitable gifting strategies

Coordination with your CPA or tax preparer

-

Retirement cash flow projections

Retirement income and Required Minimum Distribution (RMD) planning

Social Security and Medicare planning

Pension benefit analysis

Stock options and executive compensation

Sensitivity analysis and “what-if” scenario planning

-

Reducing and/or avoiding estate tax and gift tax

Reviewing and/or updating estate planning documents and beneficiary designations

Wealth transfer strategies and intergenerational financial planning

Living and testamentary gifting

Coordination with your estate planning attorney

-

Cash flow analysis and savings strategies

Goal creation, tracking, and likelihood of success analysis

Behavioral finance coaching

Major expense planning

Education planning

Debt analysis and repayment strategy

Workplace benefits review

-

Insurance (life, disability, long-term care, property, casualty, etc.) needs analysis

Insurance gap analysis

Annuity analysis

Coordination with your insurance agent(s)

Tiers of Service

Onyx Wealth Management has 4 tiers of service, all of which begin with a complimentary introductory call. In this call, we will learn about one another and determine the best way to move forward.

Financial Wellness Review

-

This one-time service includes a basic review of your financial life and quick tips to make the most of your situation. This tier can also be an exploratory conversation if you want to enhance your understanding of personal finance.

-

$250

-

Introductory Call

Financial Wellness Review

Comprehensive Financial Plan

-

This one-time service includes an in-depth evaluation of all aspects of your financial life. We will map out your current trajectory, highlight opportunities for improvement, and share actionable steps to reach your goals.

-

Plan Levels

Level 1: $1,750

Level 2: $2,500

Level 3: $4,000

We will determine your financial plan level in our introductory call. Your plan level will be based on the depth of analysis you request and the degree of complexity.

-

Introductory Call

Data Gathering Meeting

Presentation Meeting

Ongoing Financial Planning

-

This is an ongoing service where we will regularly review and update all facets of your financial plan. As your life evolves and the world continues to change, this tier of service will put you in the best position to reach your goals in an efficient manner.

-

$1,000 initial fee + $500 per quarter

*Above $500,000 of assets managed by Onyx, ongoing financial planning is complimentary.

-

Introductory Call

Data Gathering Meeting

Presentation Meeting

Monitoring Meetings

Investment Management

-

This is an ongoing service where we will create a custom investment plan (given your unique needs, circumstances, and risk tolerance) and proactively manage your investments. We will have regular meetings to review investment performance and discuss how Onyx is dynamically positioning your portfolio to take advantage of the ever-changing economic conditions.

-

The annual fee will be based on the asset management fee schedule below.

*Above $500,000 of assets managed by Onyx, ongoing financial planning is complimentary.

-

Introductory Call

Data Gathering Meeting

Presentation Meeting

Monitoring Meetings

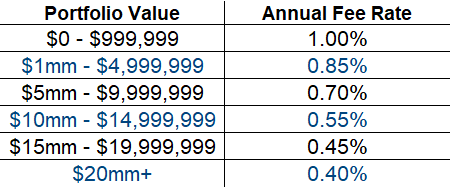

Asset Management Fee Schedule

*The annual fee rate applies to your total portfolio under Onyx management.

Example: If Onyx is managing $2mm of your assets, the entire $2mm will have a fee of 0.85% instead of the first $999,999 having a fee of 1.00% and the remainder having a fee of 0.85%.

**Fees will be billed quarterly and debited directly from your investment account(s).